Markets Await Key Diplomatic and Central Bank Developments

Most Asian markets concluded the week with losses on Friday, pulling back from recent gains as investor focus shifted towards significant upcoming events, including a pivotal telephone call between U.S. President Donald Trump and Chinese President Xi Jinping. The widespread decline came at the end of a generally strong week for global investors, who had been buoyed by a recent interest rate cut from the U.S. Federal Reserve. Adding to the selling pressure across the region were growing expectations that Japan’s central bank is moving closer to hiking its own interest rates later this year. This cautious sentiment permeated trading floors, overshadowing the positive momentum seen earlier in the week. The scheduled discussion between the leaders of the world’s two largest economies, coupled with uncertainty surrounding future monetary policy in Japan, prompted traders to adopt a more risk-averse stance as the week drew to a close.

The downturn in Asia contrasted with a more bullish atmosphere in the United States, where markets had continued their upward trajectory. The positive sentiment in the U.S. was largely fueled by optimism in the technology sector and the Federal Reserve’s recent policy adjustment. However, in Asia, the combination of geopolitical and economic policy uncertainty proved to be a significant headwind. The day’s trading was characterized by a gradual increase in selling activity, particularly after the Bank of Japan released the results of its latest policy meeting, which contained nuances that suggested a tighter monetary policy could be on the horizon. Investors are now closely monitoring the outcomes of these high-stakes events, which are expected to set the tone for market activity in the near future.

U.S. Federal Reserve Decision and Market Reaction

Earlier in the week, the U.S. Federal Reserve provided a significant boost to market sentiment by lowering borrowing costs. This decision, made on Wednesday, marked the first reduction in interest rates since December. The central bank’s move was a response to a series of economic reports that indicated a slowdown in the country’s labor market. While inflation has remained stubbornly high, the signs of a cooling job market were sufficient for policymakers to proceed with the cut. The Federal Reserve and its chief, Jerome Powell, were not as explicit about the path of future rate reductions as some investors had hoped. Despite the lack of aggressive forward guidance, the overall mood on trading floors remained upbeat following the announcement.

A closely watched gauge of market expectations for future policy moves continued to indicate that two additional rate cuts could occur before the end of the year. However, Powell emphasized that any future decisions would be strictly data-dependent, meaning the central bank will react to incoming economic figures rather than following a predetermined path. Illustrating this point, fresh data showing a sharp drop in initial jobless claims for the past week did not significantly alter expectations for further rate cuts. According to Rodrigo Catril of National Australia Bank, the underlying trend in claims still suggests a gentle increase, reinforcing the view that the U.S. labor market is not exhibiting signs of a sudden or severe weakening. The combination of the rate cut and the resilient economic data propelled all three main U.S. stock indexes to end Thursday’s session at record highs, continuing a powerful trend that has defined market performance in recent months, largely driven by a surge in major technology companies.

Bank of Japan Holds Rates Amid Hike Speculation

In a key development for Asian markets, the Bank of Japan (BOJ) concluded its latest policy meeting on Friday. Monetary policymakers decided to keep interest rates on hold, maintaining the current accommodative stance. However, the decision was not unanimous, with the final tally revealing a surprise 7-2 vote. This split indicated that two members of the policy board were in favor of an immediate rate hike. The dissent within the board significantly boosted market bets that such a move will happen before the end of the year. The BOJ’s decision-making process is taking place against a backdrop of lingering political uncertainty and economic concerns, which have been fueled in part by U.S. tariffs.

In addition to its rate decision, the central bank also announced its intention to begin offloading exchange-traded funds (ETFs) from its balance sheet. These ETFs were purchased as part of the bank’s extensive monetary easing campaigns in previous years, a program designed to support the economy and boost equity prices. The plan to start selling these assets marks another step towards policy normalization. Commenting on the split vote, National Australia Bank’s Rodrigo Catril noted that the presence of dissenters was a “strong signal that the BOJ will be hiking once political uncertainty is removed.” Before the central bank’s announcement, official data provided further insight into the country’s economic state. Inflation in the world’s fourth-largest economy slowed to 2.70 percent in August. A notable detail within the report was the easing of rice price increases, which had previously spiked sharply and caused concern for the government. Following the meeting, traders and analysts are now awaiting a news conference from BOJ Governor Kazuo Ueda for further clarification on the bank’s future policy direction.

Key Market Takeaways

- Most Asian markets registered declines on Friday amid investor caution.

- The Bank of Japan maintained its current interest rates, but a divided 7-2 vote signaled a future hike.

- The U.S. Federal Reserve lowered borrowing costs for the first time since December.

- A call between Donald Trump and Xi Jinping was scheduled to discuss the TikTok app and trade relations.

- U.S. stock indexes reached record highs, partly driven by a surge in technology shares and a major chip deal.

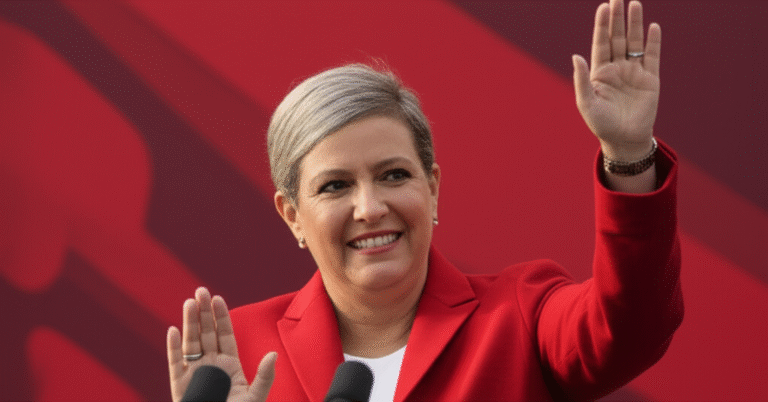

Focus Shifts to U.S.-China Diplomatic Talks

With central bank decisions digested, investor attention turned squarely to the diplomatic sphere. A phone call between President Trump and his Chinese counterpart, Xi Jinping, was scheduled for later on Friday. This conversation marks their first direct communication since June. The U.S. president informed reporters that a key topic on the agenda would be a potential deal to change the ownership structure of the widely used video-sharing application, TikTok. The discussion is seen as a critical event for U.S.-China relations, which continue to navigate complex issues.

The presidential phone call also follows a recent meeting between high-level officials from both nations in Madrid. During those talks, representatives discussed the broader trade relationship between the two economic superpowers. These discussions are particularly timely, as a deadline for a U.S. tariff pause is approaching in November. The outcome of the Trump-Xi call and the ongoing trade negotiations are expected to have a significant impact on global market sentiment, given the deep economic ties between the two countries. The talks represent a crucial opportunity to address ongoing points of friction and potentially chart a path forward on trade and technology policy. [Source]

Background

The market movements on Friday occurred within a broader context of significant economic and corporate events. The U.S. Federal Reserve’s rate cut was a pivotal moment, representing the first such reduction since December and signaling a policy shift in response to evolving labor market data. In the U.S. equity markets, the recent trend of reaching record highs has been a dominant theme, largely supported by the exceptional performance of technology giants. A recent example of the dynamism in this sector was the news that chip manufacturer Nvidia plans to invest US$5 billion in its U.S. rival, Intel. The two companies also intend to jointly develop processors for personal computers and data centers, a collaboration that further fueled positive sentiment in the tech industry.

In Japan, the central bank’s monetary policy has been a focal point for years. The Bank of Japan’s earlier easing campaigns involved the large-scale purchase of assets like exchange-traded funds to stimulate the economy, a policy from which it is now planning a gradual exit. On the geopolitical front, U.S.-China relations have been a persistent source of market uncertainty. The high-level meeting in Madrid and the upcoming presidential call are the latest in a series of engagements aimed at managing the complex trade relationship, particularly with a November deadline for a tariff pause looming.

What’s next

Looking ahead, several key events will shape market direction. The most immediate is the outcome of the phone call between Donald Trump and Xi Jinping, with investors keenly watching for any announcements regarding TikTok or progress on trade disputes. Following the Bank of Japan’s meeting, a news conference with Governor Kazuo Ueda is expected to provide more details and context for the bank’s thinking, especially regarding the timing of a potential interest rate hike, which markets now anticipate for later this year. In the United States, the Federal Reserve’s future actions remain a central theme. While market indicators suggest two more rate cuts may be forthcoming this year, Chairman Jerome Powell’s emphasis on a data-dependent approach means that upcoming economic reports on inflation and employment will be scrutinized heavily. Finally, the approaching November deadline for the U.S. tariff pause on Chinese goods will keep the focus on trade negotiations, with any developments likely to influence global economic sentiment.