The US Federal Reserve is expected to implement its first interest rate cut of the year during its policy meeting this week. This decision follows a weakening jobs market and coincides with considerable political tension. The Fed’s potential action comes after a month-long effort by President Donald Trump to decrease rates, raising concerns about political pressure on the independent central bank. Since December’s rate reduction, interest rates have remained between 4.25 percent and 4.50 percent, while policymakers monitor the effects of Trump’s tariffs on inflation. Analysts predict a 25 basis points rate cut following the two-day meeting on Wednesday, as hiring slows. This anticipated rate cut highlights the intricate interplay between economic indicators and political influences on monetary policy decisions. The Federal Reserve’s independence and its ability to make decisions based solely on economic data are key considerations during this period of political pressure.

Interest Rate Cut and Political Climate

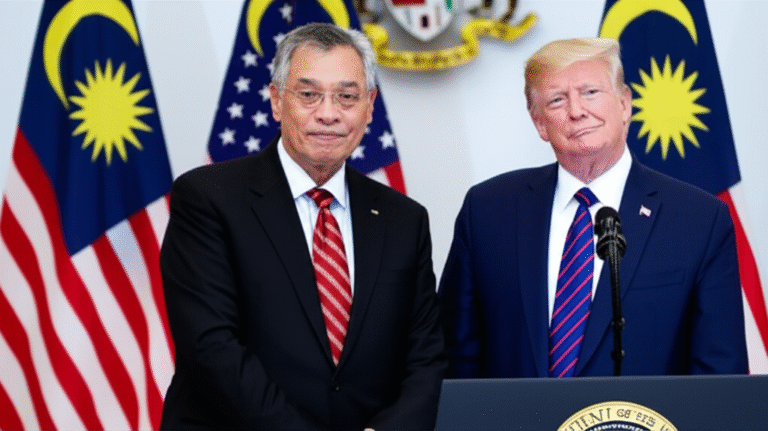

The upcoming Federal Reserve meeting is generating significant attention due to the combination of an anticipated interest rate cut and the ongoing political tension. Josh Lipsky, chair of international economics at the Atlantic Council, observes that despite the clear expectation of a rate cut, considerable drama surrounds the meeting. This drama stems from ongoing personnel issues within the rate-setting Federal Open Market Committee (FOMC). While President Trump has ceased threats to remove Fed Chair Jerome Powell, he attempted to fire Fed Governor Lisa Cook in August. Governor Cook, the first Black woman to serve on the Fed’s Board of Governors, challenged her dismissal legally, successfully remaining in her position while the lawsuit proceeds. This legal challenge has implications for future potential removals of Fed officials. The recent resignation of another Fed governor, Adriana Kugler, further adds to the personnel changes affecting the Federal Reserve.

Potential New Fed Governor and Implications

The vacancy created by Governor Kugler’s resignation has led President Trump to nominate his chief economic adviser, Stephen Miran, to fill the position. Mr. Miran, who chairs the White House Council of Economic Advisers, has faced criticism from Democratic lawmakers due to his proposed leave of absence—instead of resignation—from the Trump administration if confirmed. Despite this criticism, his nomination has advanced. If confirmed by the Senate, he could participate in the Fed’s next rate meeting. The potential addition of Mr. Miran to the FOMC adds another layer of complexity to the already politically charged atmosphere surrounding the Federal Reserve’s upcoming decisions. The potential for shifts in the FOMC’s composition and decision-making process is a key factor influencing market expectations and overall economic outlook.

Economic Factors and Recession Risks

The Federal Reserve’s decision will be heavily influenced by economic factors, including the current state of the job market and inflation. The labor market is showing signs of weakness, with stagnant job growth, negative worker sentiment, and unemployment exceeding estimates of full employment. These factors increase the risk of a recession. Inflation, as measured by the consumer price index (CPI), rose to 2.9 percent in August, its highest level this year. This inflation data adds another dimension to the Fed’s deliberations. The combination of a weak labor market and persistent inflation poses significant challenges in setting monetary policy. While the Fed aims to control inflation, the precarious state of the job market necessitates a careful approach to avoid further economic downturn. The Fed’s rate decision needs to balance combating inflation and mitigating recession risks.

Background

The Federal Reserve’s decision to potentially cut interest rates is largely influenced by the slowing job growth and persistent inflation. The ongoing political tension surrounding the Fed, including personnel changes and potential political pressure on the central bank’s independence, adds a significant layer of uncertainty to the situation. President Trump’s past actions and recent appointments to the Fed have raised concerns about the balance between political influence and the central bank’s ability to make independent economic decisions. The economic indicators, particularly the slowing job market and the rise in inflation, are key factors in determining the Fed’s response. These concerns need to be weighed against the potential risks associated with altering interest rates, including the possibility of exacerbating inflation or triggering an economic downturn.

What’s next

The market will closely scrutinize the signals provided by the Fed regarding its future rate cuts. The size and pace of future cuts will be a major focus for investors and economists alike. The Fed’s communication on inflation risks will also be significant. The ongoing political dynamics within the Fed, including the potential confirmation of Stephen Miran, will continue to influence expectations and create uncertainty about the direction of future monetary policy. The potential for a divided FOMC, which is unusual, will also be closely monitored. The level of division within the committee on the optimal rate cut (25 basis points, 50 basis points, or no change) is a significant area of attention for observers. Analysts caution that shifts in the Fed’s composition may occur more rapidly than anticipated, highlighting the potential for future changes to further impact monetary policy decisions.

- The Federal Reserve is expected to cut interest rates this week.

- Political tension and personnel changes are impacting the Federal Reserve.

- Concerns exist regarding the independence of the Federal Reserve.

- The labor market is weak, and inflation remains a concern.

- The Fed’s future actions will be closely watched by markets.

[Source](https://tribune.net.ph/2025/09/14/us-fed-sets-first-rate-cut-as-tension-mounts)