U.S. farmers are weeks away from harvesting soybeans, yet the world’s largest buyer, China, has not placed any orders for autumn shipments, a significant departure from last year’s purchasing trends. This absence of orders for U.S. soybean exports is intensifying anxiety throughout the American farm belt, signaling a critical juncture for agricultural trade policies.

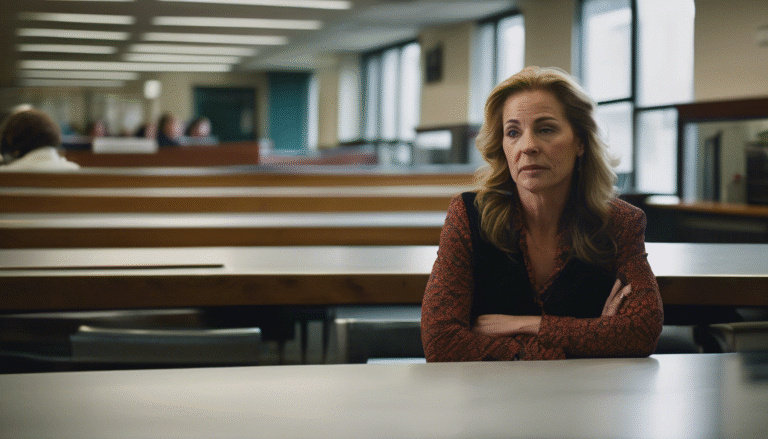

Last year, by this point, China had already committed to over 13 million metric tons of U.S. soybeans. The current silence from Beijing regarding new purchases casts a shadow over what farmers describe as ideal growing conditions. Tim Maxwell, an experienced farmer in Iowa, highlighted the severity of the situation, stating, “This year’s yield and weather conditions were ideal, but the lack of market will put tremendous pressure on many farmers.” This sentiment underscores the immediate financial challenges confronting agricultural producers.

“This year’s yield and weather conditions were ideal, but the lack of market will put tremendous pressure on many farmers.” — Tim Maxwell, farmer in Iowa.

In an effort to alleviate the ongoing trade impasse, the U.S. government is reportedly organizing a delegation of farmers and agricultural exporters to visit Beijing this fall. This upcoming trip marks the third annual visit of its kind, reflecting sustained industry efforts to secure much-needed orders from the Chinese market. The consistent push by American agricultural sectors highlights the strategic importance of China as a destination for U.S. products.

The American Soybean Association issued a stark warning in August, emphasizing that farmers cannot sustain casual trade policies, particularly if China continues to withhold its demand. Caleb Ragland, president of the association, articulated the critical challenge, explaining that domestic and alternative markets are insufficient to compensate for the void left by diminished Chinese demand. This substantial reduction in purchases has already exerted downward pressure on commodity prices, directly impacting farmers’ livelihoods.

Shifting Global Soybean Procurement Trends

The stakes involved in this trade dynamic are considerably high, as evidenced by historical purchasing patterns. In 2016, China sourced 41% of its soybeans from the U.S. However, by 2024, this share had plummeted to approximately 20%, according to Reuters, citing customs data. This dramatic shift illustrates a significant reorientation in China’s sourcing strategy over a relatively short period.

Concurrently with the decline in U.S. soybean exports to China, there has been a notable surge in imports from alternative suppliers. Last year, China imported a substantial 74.65 million metric tons of soybeans from Brazil, representing a 6.7% increase. This figure accounted for more than 70% of China’s total soybean purchases, as reported by China’s customs agency. Brazil has thus emerged as the predominant supplier, reshaping global agricultural trade flows.

Beyond diversifying its international suppliers, Beijing is also actively implementing domestic strategies to lessen its overall dependence on foreign soybeans. These efforts include adjusting feed formulas used in livestock to reduce soybean meal content and boosting domestic soybean output. These measures collectively aim to enhance China’s food security and reduce its vulnerability to global market fluctuations and trade disputes.

Economic Impact of Tariffs on U.S. Soybean Exports

The broader economic implications of current trade policies are substantial. Christopher A. Wolf, an economist at Cornell University, observed that “Procurement trends in the Chinese market carry significant weight” and that “Tariffs have caused intense volatility and uncertainty for U.S. farmers.” These tariffs, implemented by the U.S. government, have demonstrably disrupted established supply chains and created an unstable environment for agricultural producers.

The crisis in agricultural trade extends beyond just soybeans. A BBC report indicates that since U.S. President Donald Trump announced so-called “reciprocal tariffs” in April, China’s orders for a wide array of U.S. agricultural products have seen a sharp decline. This broader impact underscores the systemic nature of the challenges facing American agriculture in the current trade climate.

Further exacerbating the situation, Bloomberg data reveal that bankruptcy filings among small farm businesses reached a five-year high in July. This statistic paints a stark picture of the financial distress permeating the agricultural sector. Chicago-based AgResource Company projects that without significant Chinese purchases before mid-November, the U.S. could face a loss of 14 to 16 million metric tons in sales this year, an outcome that would have severe repercussions for farmers and the broader agricultural economy.

The Call for Policy Adjustment

Farmers themselves are increasingly vocal about the mounting pressure. Reports indicate that some Midwest growers, who had previously supported President Trump, are now advocating for a reduction in tariffs. “It’s time to lower tariffs,” these growers told reporters, reflecting a growing consensus among those directly impacted by current trade policies.

This sentiment contrasts with earlier statements from President Trump, who in March touted an approaching “bumper harvest” on social media, just prior to announcing the tariffs. Six months later, while the harvest has indeed arrived as predicted, the critical orders from China have not materialized, creating a significant disconnect between agricultural output and market access.

The combination of a strong domestic yield, the absence of major international buyers, and the financial strain from depressed prices and tariff-induced uncertainty has created a complex and challenging environment for U.S. agriculture. The ongoing wait for orders from China continues to be a primary source of concern for farmers across the nation.

Background

The current predicament concerning U.S. soybean exports and other agricultural products did not emerge in a vacuum. The trajectory of Chinese procurement from the U.S. has been on a downward trend for several years, accelerating after the announcement of “reciprocal tariffs” in April. This policy shift followed a period where China was a dominant buyer, accounting for a significant portion of U.S. soybean sales.

Historically, China’s reliance on U.S. agricultural products, particularly soybeans, was substantial. In 2016, a considerable 41% of China’s soybean imports originated from the United States. This strong commercial relationship began to shift, leading to a reduction in the U.S. market share to about 20% by 2024. This decline predates the most recent tariff announcements but was significantly exacerbated by subsequent trade measures.

The industry’s response to this evolving trade landscape has included consistent engagement with Chinese officials. The upcoming delegation visit to Beijing this fall represents the third annual endeavor by U.S. farmers and agricultural exporters to secure orders. These recurring visits underscore the persistent efforts by the American agricultural sector to navigate and mitigate the impacts of strained trade relations, particularly in the critical Chinese market.

What’s next

The immediate future for U.S. soybean exports remains characterized by uncertainty and high stakes. The impending harvest season, combined with China’s continued lack of orders for autumn shipments, places immense pressure on the market. The U.S. government’s planned delegation of agricultural representatives to Beijing this fall represents a key upcoming event, as the industry seeks to break the current stalemate and secure vital purchases.

The forecast from AgResource Company, predicting a potential loss of 14 to 16 million metric tons in U.S. sales if Chinese purchases do not materialize before mid-November, highlights a critical timeline for farmers. This deadline adds urgency to the ongoing efforts to resolve trade tensions and re-establish market access. The financial health of numerous farm businesses hinges on the resolution of these procurement issues.

Moreover, the growing calls from Midwest growers for a reduction in tariffs signal a potential shift in policy sentiment. The outcome of these calls and the effectiveness of diplomatic efforts in Beijing will significantly shape the trajectory of U.S. agricultural exports in the coming months. The ability to lower trade barriers and restore consistent demand from major buyers like China will be paramount for mitigating the current pressures on American farmers.

- China has not placed any orders for U.S. soybean shipments for the autumn harvest.

- The U.S. government plans to send a delegation of farmers to Beijing this fall.

- China’s share of U.S. soybean purchases dropped from 41% in 2016 to about 20% by 2024.

- China imported over 70% of its soybeans from Brazil last year.

- Bankruptcy filings among small U.S. farm businesses reached a five-year high in July.

Source: [Source]